9 photos

Aviation networking – A haven for plane enthusiasts, the air show is a great networking opportunity where orders are placed, deals made and multimillion-dollar contracts signed.

Hide Caption

5 of 9

9 photos

Up in the cloud – Passengers currently have access to the Internet for 24% of all miles flown. Customers expect to be connected on the ground and they're increasingly demanding it when flying. Solutions for larger bandwidths, better security and integration of smart technologies with on-board services are likely to be on the agenda.

Hide Caption

6 of 9

9 photos

Aerial acrobatics – Not all planes at Le Bourget need to be smartphone friendly. Here jets from the French Air Force precision flying team, La Patrouille de France, perform in 2013. Expect more of the same this year.

Hide Caption

7 of 9

9 photos

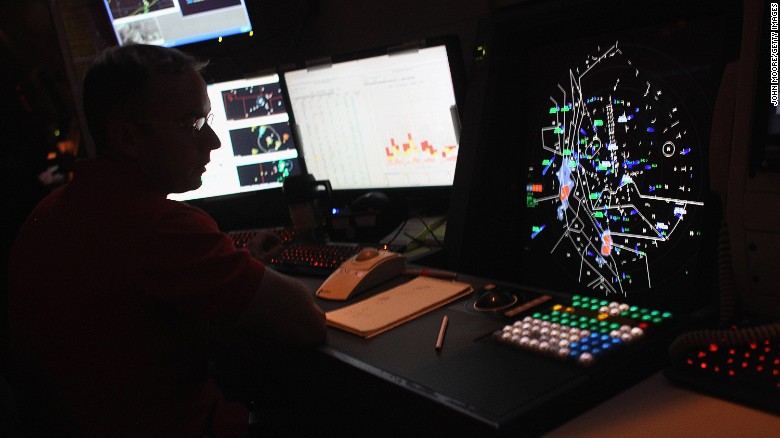

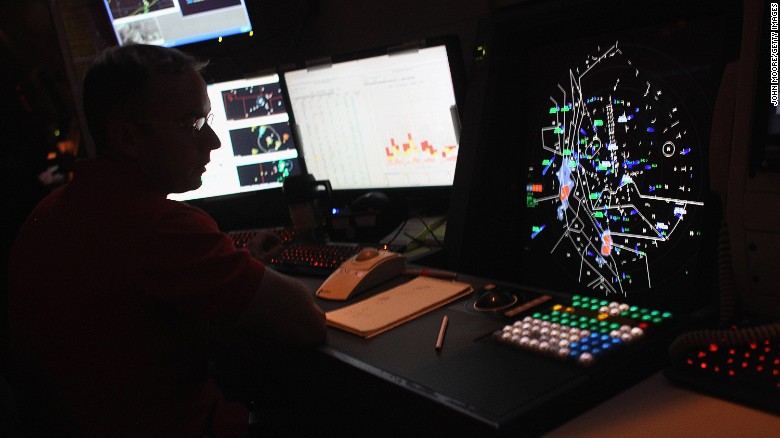

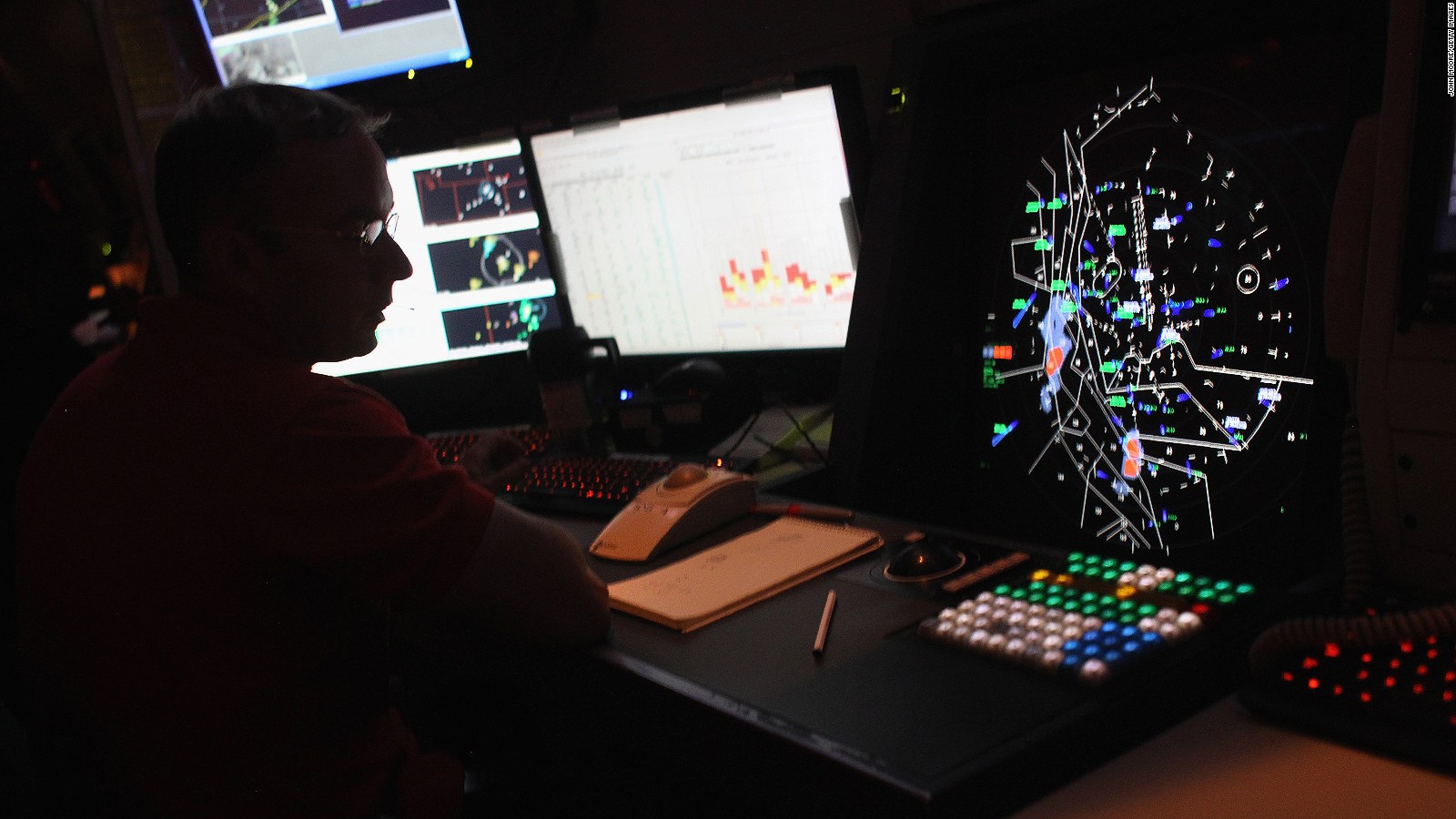

Real-time monitoring – The so-called Internet of Things, where numerous devices can communicate online, is hardly a new concept for the aerospace industry. Now innovators are aiming for real-time flight health monitoring from the skies and relaying all this information to operations on the ground.

Hide Caption

8 of 9

9 photos

Aviation technology – Le Bourget has always been home to cutting edge aviation technology. In 2011, Swiss solar-powered aircraft Solar Impulse took off for a demo flight. Four years later, the Solar Impulse team is halfway through circumnavigating the world.

Hide Caption

9 of 9

9 photos

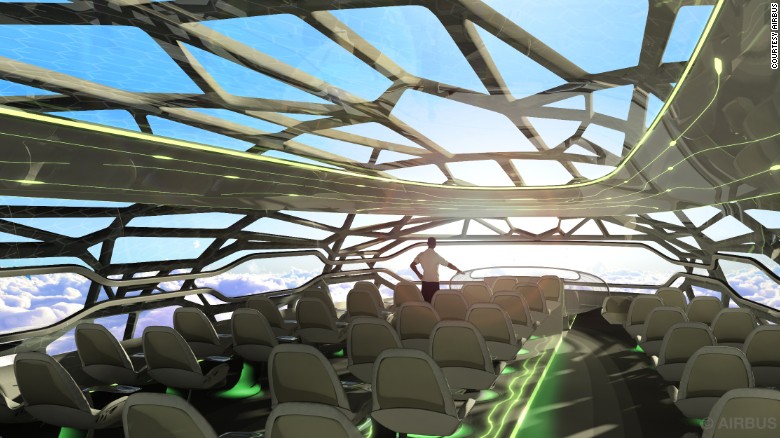

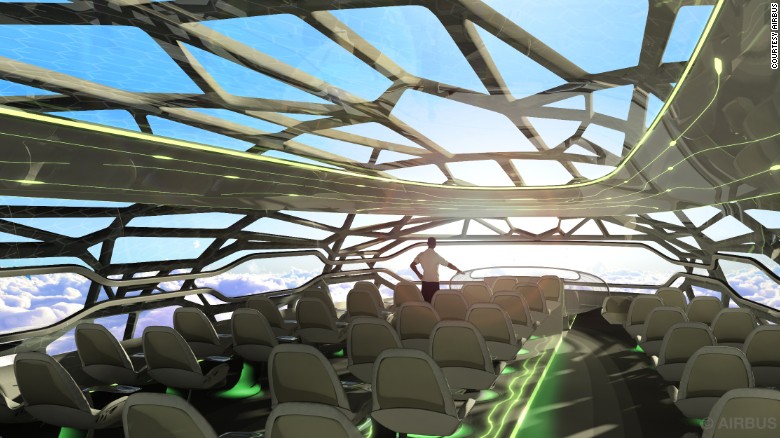

Cabin designs of the future – A focus of this year's Paris Air Show is likely to be aircraft cabins of the future. Airlines want designers to maximize passenger capacity. But those that turn left when they enter the plane are living in increased luxury. There have been calls for intermediaries between the economy-, business- and first-class model. Expect examples of five class cabins to be on show this year.

Hide Caption

1 of 9

9 photos

Safe space for drones – Drones are now being used for disaster relief, commercial deliveries and collecting news footage. But they're also becoming the news. High-profile crashes, incursions into private property and near-misses with commercial planes have caught the industry off guard. Expect new solutions to be announced as to how such incidents can be avoided.

Hide Caption

2 of 9

9 photos

Military muscle – Not that all drones on display will be for civilian use. Expect more on show like Israeli's Elbit System Hermes 900 unmanned aerial vehicle, seen here on display at Le Bourget 2013.

Hide Caption

3 of 9

9 photos

Asia's infrastructure issues – Air travel in Asia is booming, but the industry faces major issue. Where will the huge new fleets that feed this demand reside? Where will they be maintained? Crucially, where will they take off and land? New regional hubs will be required -- expect solutions to be thrashed out on the floor of Le Bourget.

Hide Caption

4 of 9

9 photos

Aviation networking – A haven for plane enthusiasts, the air show is a great networking opportunity where orders are placed, deals made and multimillion-dollar contracts signed.

Hide Caption

5 of 9

9 photos

Up in the cloud – Passengers currently have access to the Internet for 24% of all miles flown. Customers expect to be connected on the ground and they're increasingly demanding it when flying. Solutions for larger bandwidths, better security and integration of smart technologies with on-board services are likely to be on the agenda.

Hide Caption

6 of 9

9 photos

Aerial acrobatics – Not all planes at Le Bourget need to be smartphone friendly. Here jets from the French Air Force precision flying team, La Patrouille de France, perform in 2013. Expect more of the same this year.

Hide Caption

7 of 9

9 photos

Real-time monitoring – The so-called Internet of Things, where numerous devices can communicate online, is hardly a new concept for the aerospace industry. Now innovators are aiming for real-time flight health monitoring from the skies and relaying all this information to operations on the ground.

Hide Caption

8 of 9

9 photos

Aviation technology – Le Bourget has always been home to cutting edge aviation technology. In 2011, Swiss solar-powered aircraft Solar Impulse took off for a demo flight. Four years later, the Solar Impulse team is halfway through circumnavigating the world.

Hide Caption

9 of 9

9 photos

Cabin designs of the future – A focus of this year's Paris Air Show is likely to be aircraft cabins of the future. Airlines want designers to maximize passenger capacity. But those that turn left when they enter the plane are living in increased luxury. There have been calls for intermediaries between the economy-, business- and first-class model. Expect examples of five class cabins to be on show this year.

Hide Caption

1 of 9

9 photos

Safe space for drones – Drones are now being used for disaster relief, commercial deliveries and collecting news footage. But they're also becoming the news. High-profile crashes, incursions into private property and near-misses with commercial planes have caught the industry off guard. Expect new solutions to be announced as to how such incidents can be avoided.

Hide Caption

2 of 9

9 photos

Military muscle – Not that all drones on display will be for civilian use. Expect more on show like Israeli's Elbit System Hermes 900 unmanned aerial vehicle, seen here on display at Le Bourget 2013.

Hide Caption

3 of 9

9 photos

Asia's infrastructure issues – Air travel in Asia is booming, but the industry faces major issue. Where will the huge new fleets that feed this demand reside? Where will they be maintained? Crucially, where will they take off and land? New regional hubs will be required -- expect solutions to be thrashed out on the floor of Le Bourget.

Hide Caption

4 of 9

9 photos

Aviation networking – A haven for plane enthusiasts, the air show is a great networking opportunity where orders are placed, deals made and multimillion-dollar contracts signed.

Hide Caption

5 of 9

(CNN)As the world's oldest and largest air show, the Paris Air Show is the undisputed queen of its kind.

The tarmac of Paris-Le Bourget Airport is set, once again, to be heaving with manufacturers, military representatives, businessmen and the general public from across the globe.

So what will the 51st edition of the biannual spectacle, which runs June 15-21, have in store?

Here are five key trends I believe are likely to take center stage.

Regional demand from Asia

The link between air connectivity and global economic growth is profound, so it's no surprise to see the emerging economies of the world -- and those with fast growing middle classes -- experiencing the highest demand for aircraft and aerospace infrastructure.

Asia is booming.

The region is expected to represent two thirds of global aviation sector growth by 2034, so observers expect a flurry of orders from its airlines at Le Bourget.

While such rapid regional growth is sensational to watch from the sidelines, there are a number of practical considerations for those supporting larger fleets of aircraft.

Although the bulk of orders are coming from newer Asian markets, the infrastructure to support them is still mainly in Europe and North America.

Maintenance, repair and overhaul support cannot operate effectively from a distance, particularly for short-haul aircraft that dominate the market by volume -- it has to be local.

The development of regional hub networks is a crucial factor for expansion into these highly profitable regions, opening up opportunities to new players in the market.

Maintenance of aircraft is one thing, but planes also have to be able to take off and land somewhere.

The rapid population growth across Asian countries far surpasses the speed of the airport infrastructure development required to support it.

In fact, the number of airports per million people in Asia represents a fraction of 1% -- far lower than in the West.

Airport development and access to airports has to match and keep pace with population growth -- this is a much greater restriction on the region's development than the availability of aircraft.

The logistics of this, and the need to provide sufficient airport infrastructure across the region, will be a major discussion point.

The so-called Internet of Things is likely to involve more aspects of aviation.

Real-time monitoring

The Internet of Things isn't a new concept for the aviation industry.

Sensors and digital automation have been common features within manufacturing and the operation of machinery for more than a decade.

In recent years the surge of new and powerful technologies has opened commercial possibilities for aerospace and defense companies.

One area evolving rapidly is technology that enables engineers to check on the performance of every mechanical component on board a plane.

In the wake of the last year's spate of aircraft losses, renewed focus has been placed in this area.

However, there's more work to be done before real time health monitoring from the skies becomes commonplace.

I expect to see a plethora of companies working to push us closer toward comprehensive inflight monitoring and direct communication between aircraft sensors and operations on the ground.

Within the next five years or so, I'd expect significantly more ground staff to have access to a constant stream of information, giving them continual and complete understanding of an aircraft's performance.

What could this mean for the future?

Were an engine to develop issues midair, could it be possible for a standby system to kick in and run crucial systems from the ground, enabling the flight to continue safely?

The security and legal ramifications of remote operation are yet to be ironed out, and there are ongoing issues with bandwidth, but this is the direction the industry is moving.

We'll likely see major technological developments from players at the cutting edge of this market at Le Bourget this year.

The cloud in the clouds

The mobile revolution has put a smart device in the hands of almost every airline passenger -- we expect to be online at all times.

But only a fraction of air passengers can access the Internet.

There's a huge drive to change this as airlines battle for "connected customers."

Plans to roll out further "connected routes," especially on long haul flights, will certainly be on the agenda in Paris.

I predict innovations around increasing bandwidth and in security -- an area that developers will be keen to address, as inflight connectivity invariably opens the door for potential hackers.

Developments don't stop here.

The notion of the connected flier brings with it a new technological trend: the integration of connected devices with the aircraft itself.

This could be through phone or tablet apps that allow passengers to order food and drink, control inflight entertainment and adjust the lighting around their seat.

Drones and unmanned air systems are likely to command more attention than ever at this year's Le Bourget.

Cabins of the future

Aerospace interiors is a huge, exciting and innovative marketplace.

Companies big and small are drawing inspiration from other areas, such as the automotive industry, to tackle a whole range of pain point issues in the aircraft cabin.

We'll see a glimpse into the future of the cabin experience, as companies showcase solutions to issues of privacy and personal space, seat density, weight reduction and cabin ambiance.

Airlines are under increased pressure to drive down cost and boost capacity while improving their share of the lucrative first- and business-class passenger groups.

The trend for the likes of the Gulf carriers to adopt more advanced and luxurious options for upmarket passengers is set to continue.

At the other end of the spectrum, ongoing demand for low-cost air travel will focus airlines on the clever use of space and weight distribution to accommodate extra seating.

Between these two polar extremes of consumer travel, there's a growing trend toward using aircraft interiors to develop more intermediate classes.

There's talk of the traditional three (first, business, economy) being expanded to five with the addition of two more premium economy options.

Proposals for these will likely be on display at the Paris Air Show.

Safe space for drones

Drones and Unmanned Air Systems will continue to be a huge area -- the UAS market is possibly the fastest growing area in the aerospace and defense industries.

What's so astonishing about this area is the breadth of its influence.

In recent years the market has expanded from monitoring and bombing activity in war zones, to disaster relief efforts (most recently in the wake of the earthquake in Nepal), aircraft inspection for maintenance and the delivery of parcels.

The technology, which will be on display in abundance at Le Bourget, is already mature, so the discussion is likely to focus on challenges surrounding its application, for example airspace access.

The perceived lack of control and subsequent security issues in this domain have been demonstrated by recent near misses between drones and commercial aircraft, particularly

No comments:

Post a Comment